SPDR (SPY) Stock Options Cheatsheet

The investment seeks to provide investment results that, before expenses, generally correspond to the price and yield performance of the S&P 500 Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the Index), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the Index.

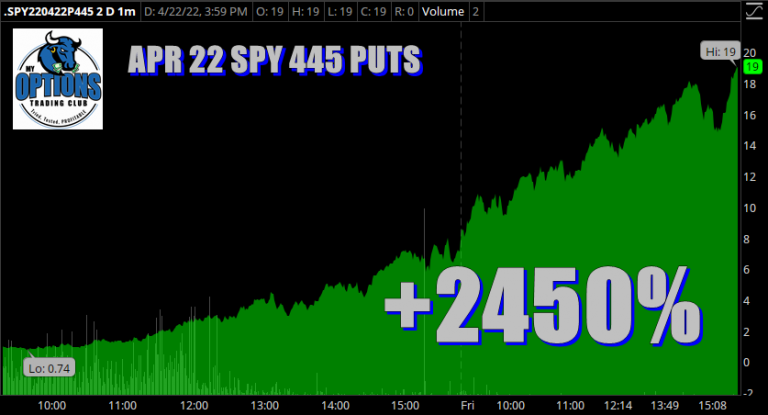

SPY options are the bread and butter for Fibonacci trading and trend trading strategies and the most popular asset to learn to trade options.

Get this week and next week’s SPY Options Trade Forecast, view by clicking here

Charts & Pivots

5 Day/15 Min

Get this week and next week’s SPY Options Trade Forecast, view by clicking here

Pivot Points

Name | SPDR S&P 500 ETF Trust | |

|---|---|---|

| Support/Resistance Levels | Price | Key Turning Points |

| 52 Week High | 565.16 | |

| Pivot Point 3rd Level Resistance | 552.93 | |

| Pivot Point 2nd Level Resistance | 550.05 | |

| Pivot Point 1st Resistance Point | 547.25 | |

| High | 547.18 | High |

| Last | 544.44 | Last |

| 544.37 | Pivot Point | |

| Pivot Point 1st Support Point | 541.57 | |

| Low | 541.50 | Low |

| Pivot Point 2nd Support Point | 538.69 | |

| Pivot Point 3rd Support Point | 535.89 | |

| 52-Week Low | 409.21 |

Come to the market prepared

In order for you to become a better, more successful trader, we provide throughout the day continual monitoring of updated watch lists, pre-market and real-time research, actionable news & filings announcements. Our members are primed to profit on the stocks that are about to, or close to, making a trade worthy move.

EVERYTHING YOU NEED TO PROFIT CONSISTENTLY!